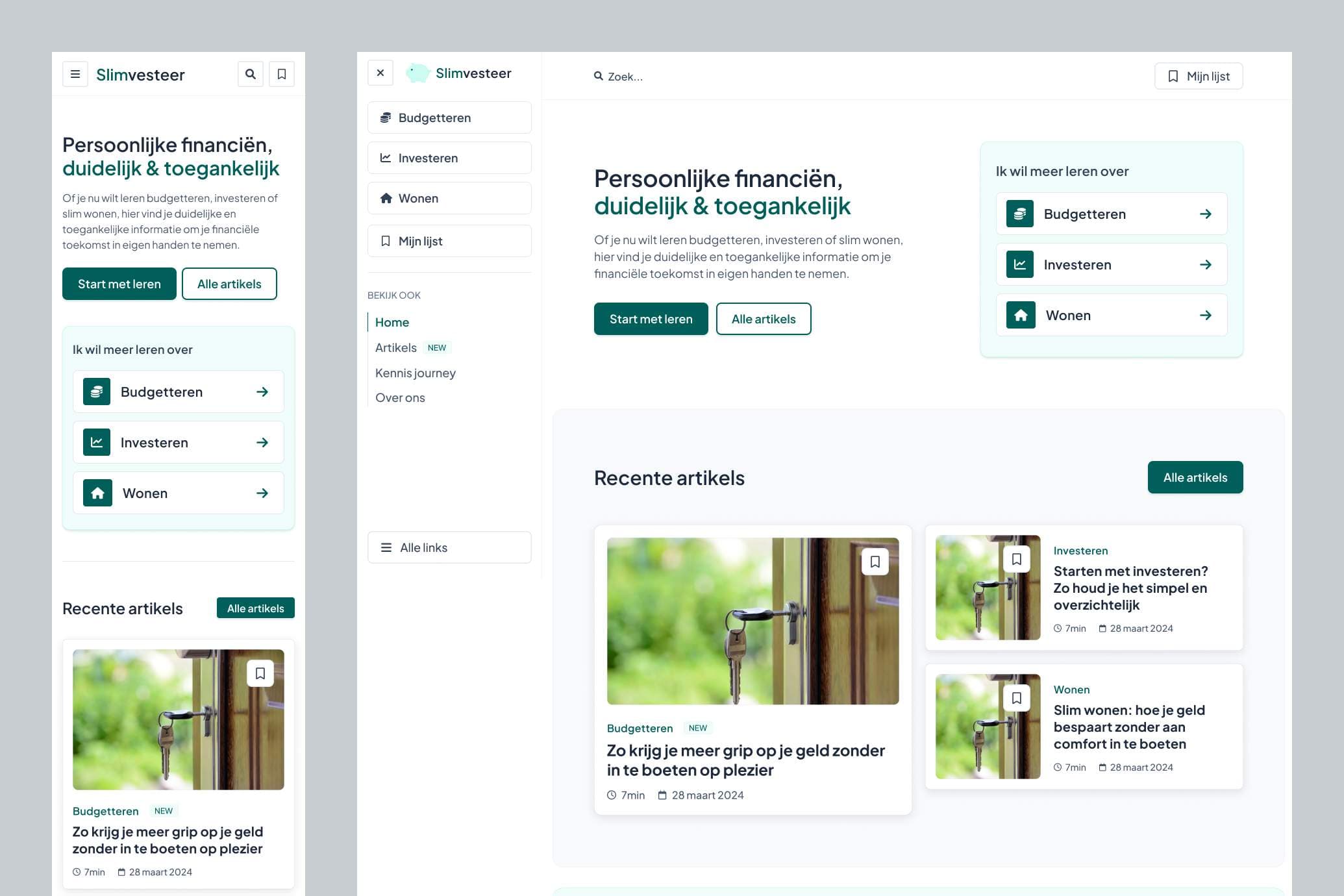

Slimvesteer

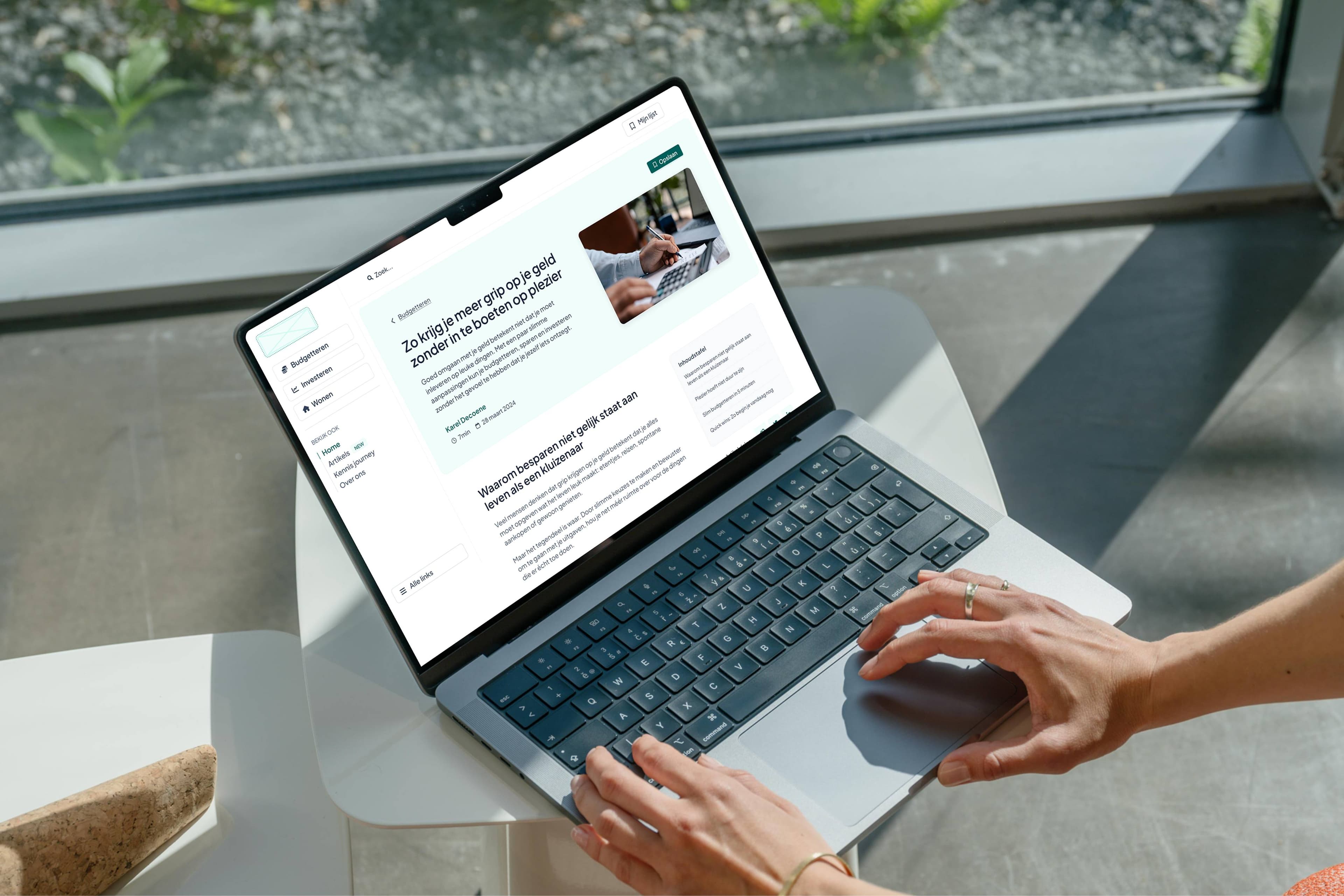

I’m handling the research, design, and development of the platform. We’ve built it to be understandable, approachable, and ready to grow into something much bigger than a blog.

Creating a personal finance platform

We want to keep it simple

Slimvesteer is a platform I’m building with a friend to make personal finance less overwhelming. The idea came from my own experience: when I bought my first home, I realized how scattered and hard-to-understand financial information really is. Between advice from my notary, parents, the bank, and endless blogs, I had to piece everything together.

That made me wonder: what happens if you don’t have that support network? Especially if you’re in your 20s, have some savings, and no clear idea where to start.

The ultimate goal

It’s not about complex investing strategies or advanced finance. It’s about helping people take their first confident step—whether it's understanding how budgeting works, learning the basics of investing, or getting a sense of what buying a home really involves.

Our goal with Slimvesteer is not to replace financial advisors or offer advanced strategies. It’s about lowering the barrier to entry: giving people clarity, confidence, and a place to take their first steps with money.

The platform should reflect three values:

- Accessibility: no jargon, no overwhelm

- Clarity: structured content to take the first step

- Scalability: room to grow into guides, tools, and interactive features

From research to product

Research – understanding the problem

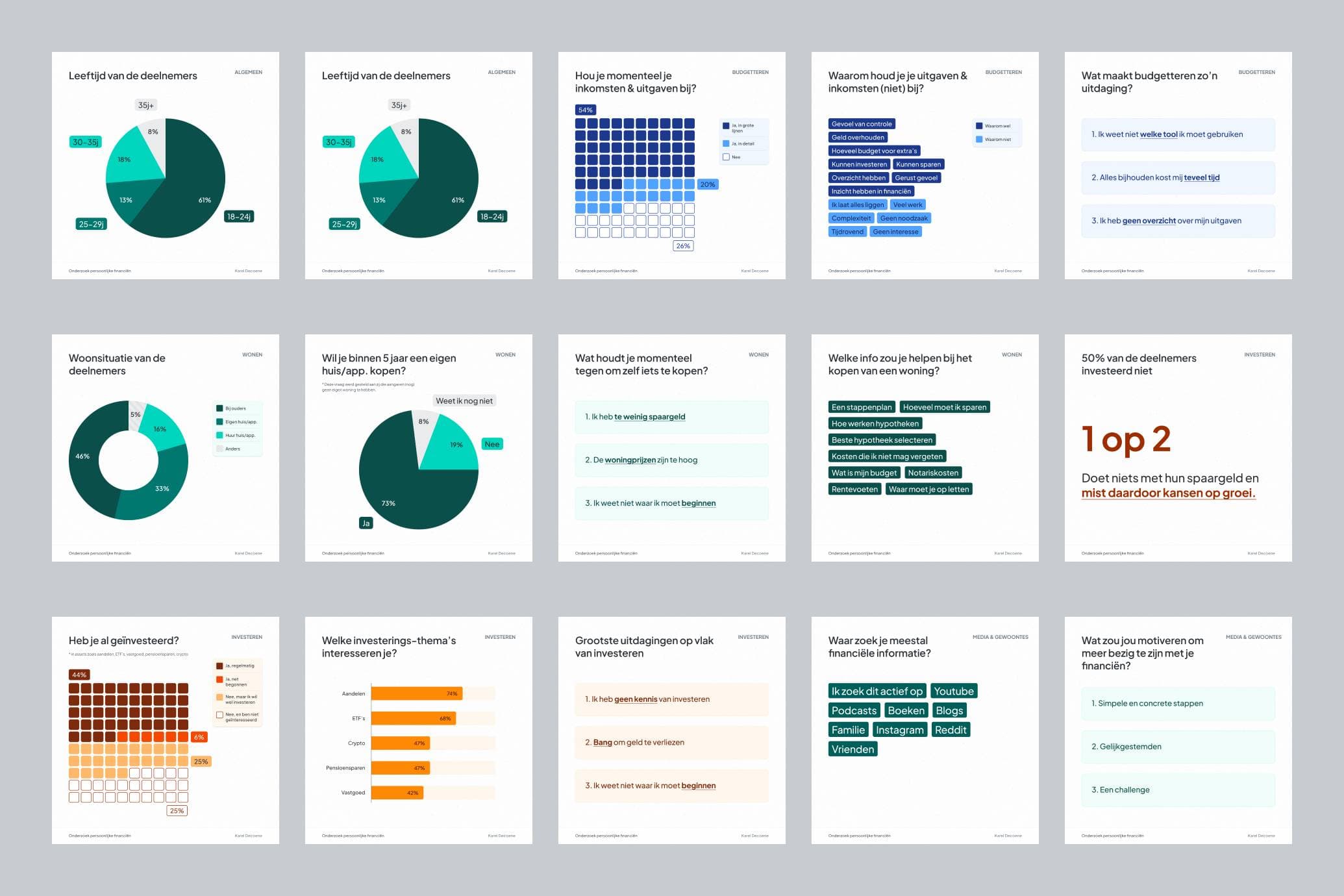

The results confirmed a big gap: most people feel lost, don’t know where to start, and are afraid of making mistakes. To make this more concrete, I turned the data into simple visuals that reflect the “average state” of personal finance. These insights helped define what the MVP should solve.

Find detailed results of the survey here

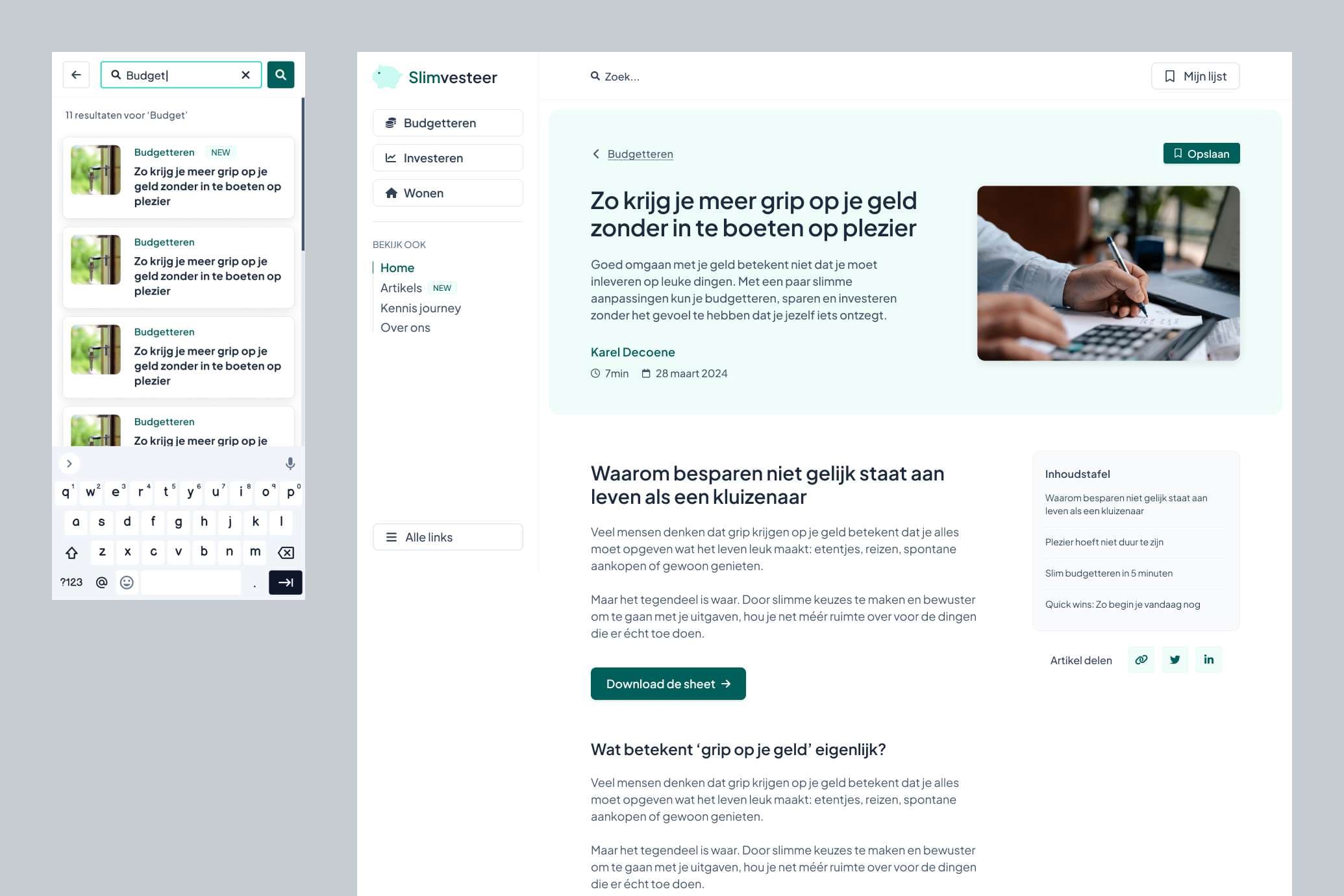

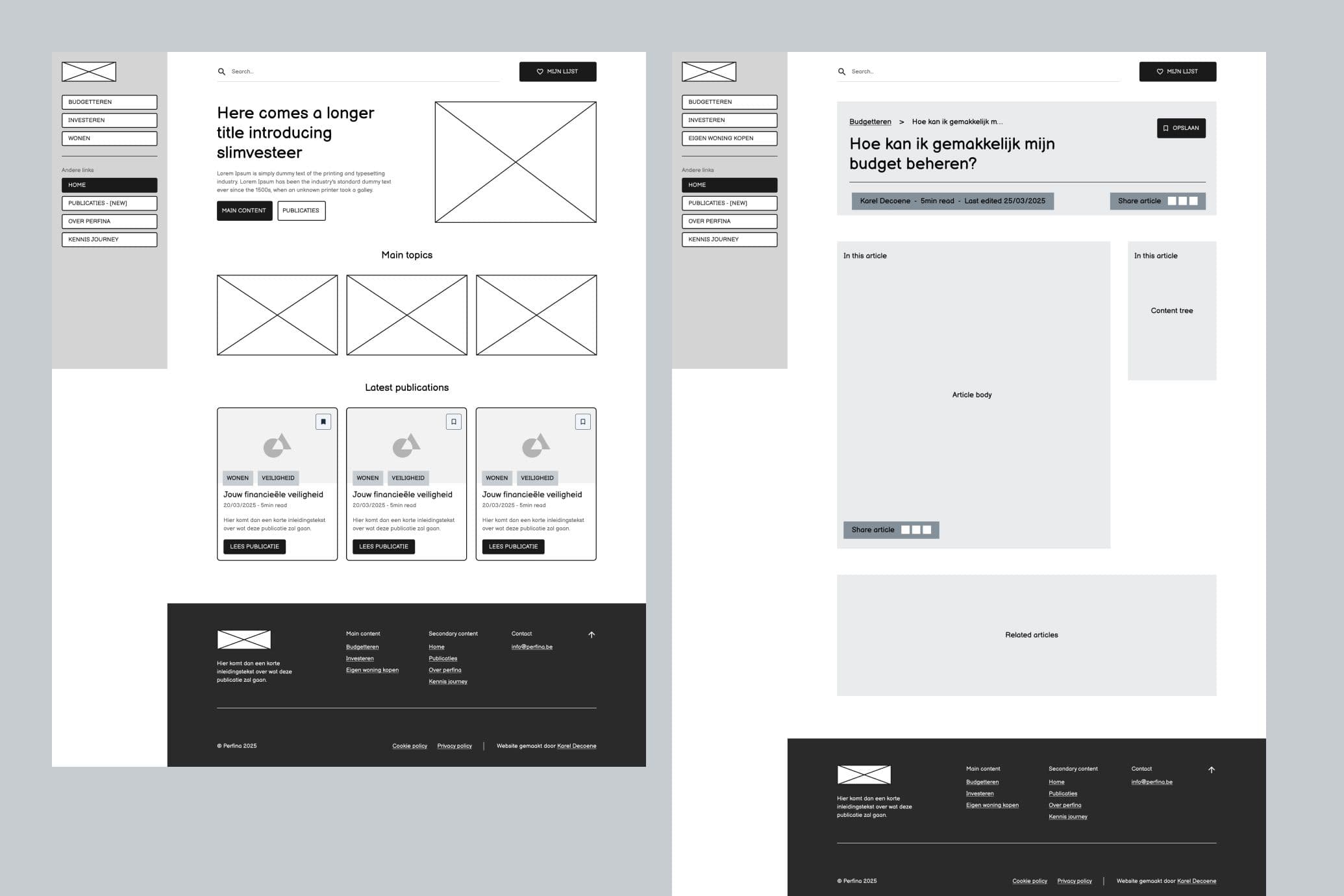

Wireframes – shaping the MVP

At first, Slimvesteer will start as a blog. Not “just another blog,” but one designed to feel more structured and accessible:

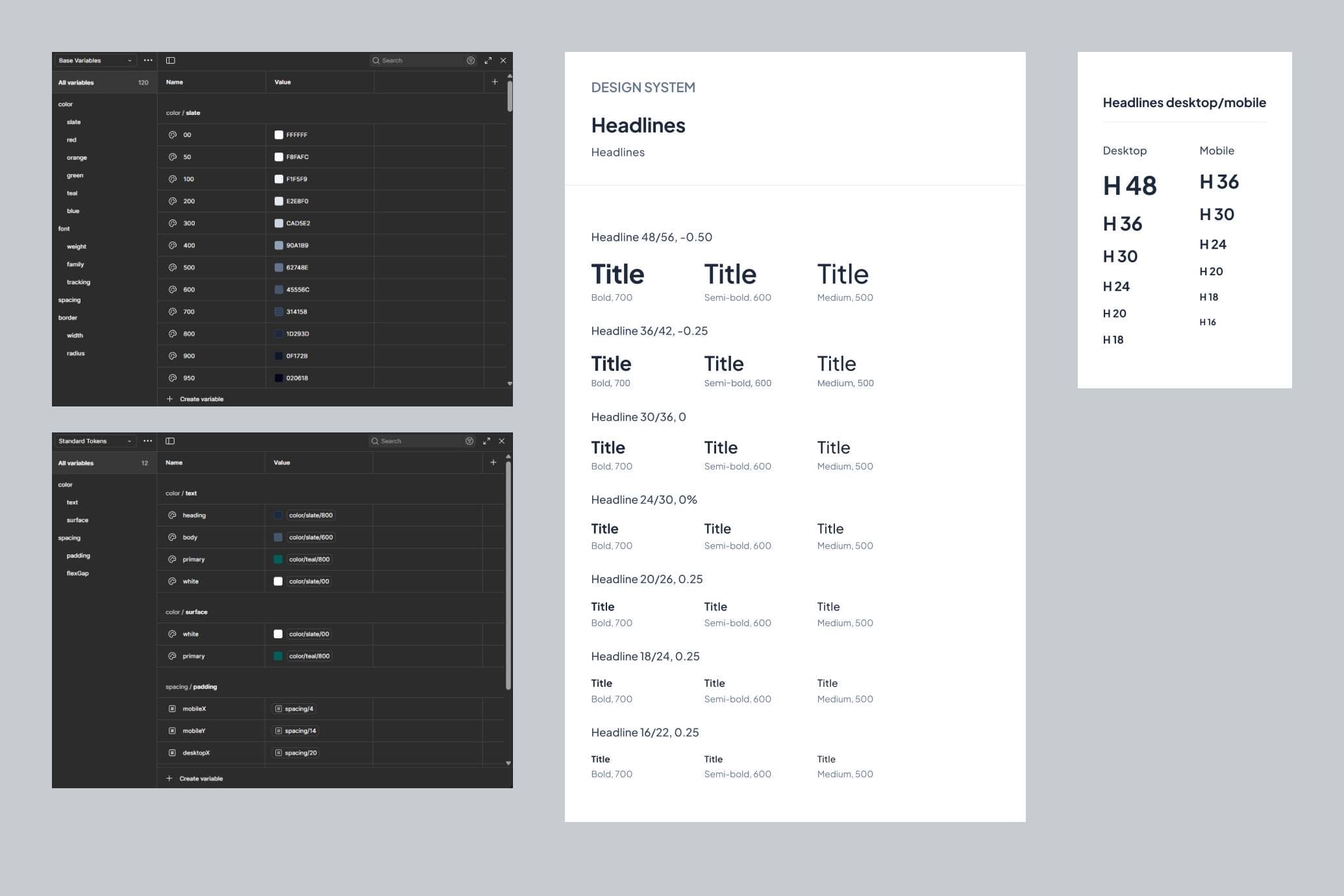

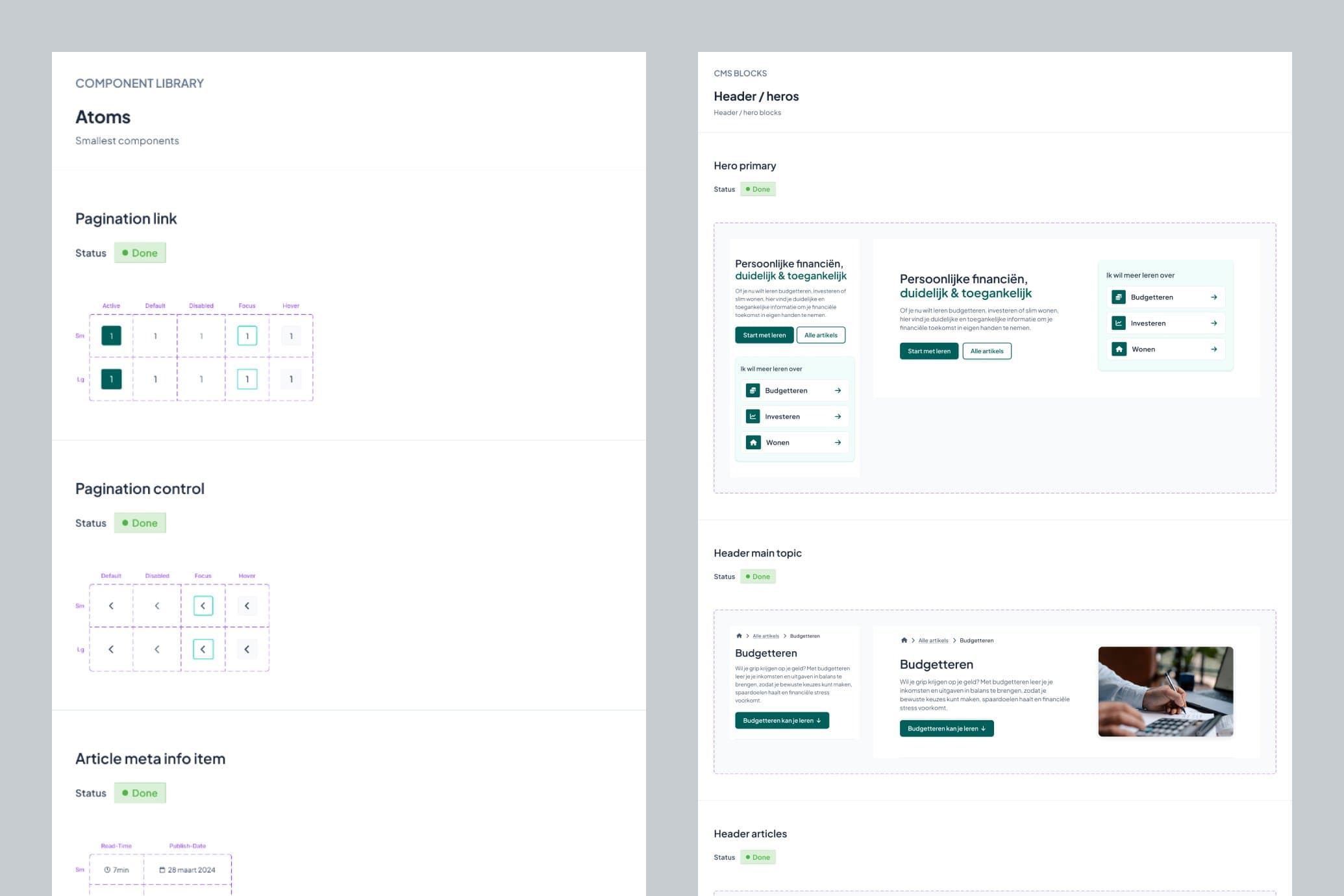

Design – building consistency in Figma

Main focus

While not forgetting about UI details

I always use this Figma Design Checklist resource to make sure my Figma file matches certain standards in terms of consistency & structure.

The MVP final result